Sri Lankans, both rich and poor alike, are fed up.

Hit by a deepening economic crisis, people in the informal settlements of the capital, Colombo, say they are eating half of what they used to as food prices have doubled in less than a year. In middle-class neighborhoods, meanwhile, owners of cafés, bakeries, and salons have had to let go of staff and are facing the prospect of closing shop altogether, with hours-long power cuts and reduced earnings keeping customers away.

“The whole country is destroyed,” said one woman in Colombo’s Nugegoda district. “Even stray dogs live better than us.”

“Everything is expensive,” said another. “We cannot manage.”

Sparked by a foreign exchange crisis, Sri Lanka – an island nation of 22 million people – is grappling with its worst economic downturn in decades.

The foreign currency crunch has left President Gotabaya Rajapaksa’s government unable to pay for fuel imports and other essentials. This has resulted in fuel shortages that have caused rolling electricity blackouts of up to 13 hours and brought ground transport in parts of the country to a halt.

Queues for diesel, cooking gas and kerosene are a common sight, with people reporting having to wait in line for days on end to get their rations. Police say at least two people have died while waiting in the scorching heat.

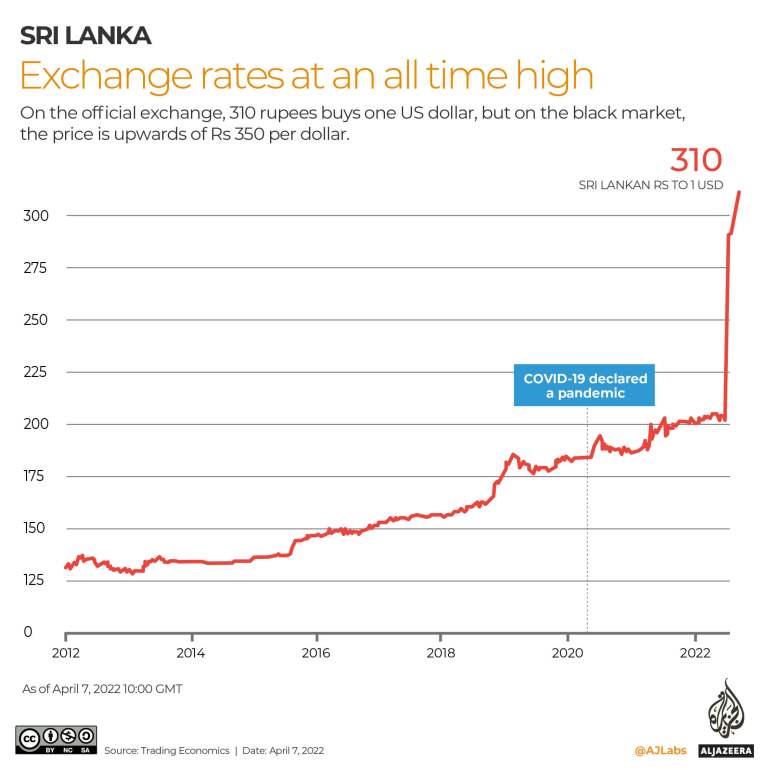

Prices of medicines have also skyrocketed, while the value of the Sri Lankan rupee has plummeted by 30 percent against the United States dollar this year, making it the worst-performing currency in the world.

The Rajapaksa government has turned to the International Monetary Fund for a bailout and is also seeking financial assistance from India, which provided a $500m credit line for fuel imports in February and approved a second $1bn credit line to help ease shortages of essentials in March.

But that has done little to end the crisis, and protests calling for the president’s resignation have broken out across the country since early March, two years after the COVID-19 pandemic decimated one of Sri Lanka’s key economic sectors: tourism. Protesters chanting “Go home, Gota”, a reference to the president’s nickname, have been taking to streets across cities and towns at different times throughout the day.

In Colombo, a city that has endured bombings, riots, curfews and rationings – mostly during Sri Lanka’s 26-year civil war against Tamil separatists, which ended in 2009 – many residents said these were the hardest times they could remember.

In Nugegoda, along a row of low-slung houses perched on the edges of a railway track, residents said they were barely making ends meet. Chandra Madhumage, who has struggled to find work as a domestic servant since the start of the pandemic, was worried she might soon run out of money to pay for medication for her diabetes and high cholesterol.

“This is a disaster,” said the mother of three. “How can we survive?”

Across the road from Madhumage’s house, DW Nimal, who was clearing weeds at the roadside with his hands, said he too was finding it hard to manage on his meagre earnings. Most of his monthly salary of 30,000 Sri Lankan rupees ($100) went to food.

“I am fed up with this life,” he said.

Up the road, Gayan Kanchana, a 42-year-old tuk-tuk driver said, “This is the hardest it’s ever been.”

The father of two said he was getting fewer and fewer calls for hires, as the cost of a ride has increased due to the doubling of the price of petrol. His family can no longer afford meat, bread, milk powder or eggs.

“We used to eat chicken two to three times a week,” he said. “Now, it’s just dried fish and rice.”

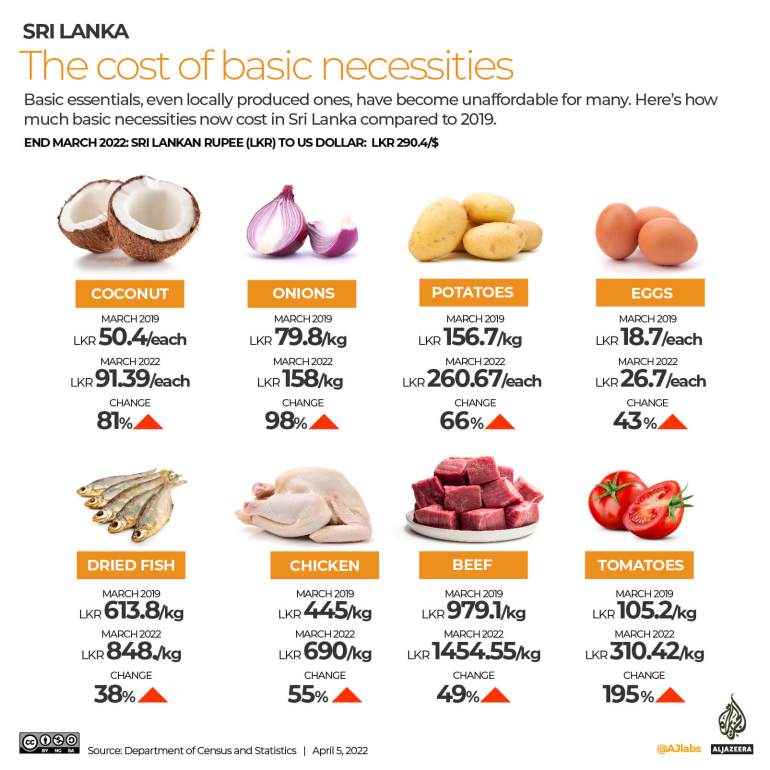

Figures from the Sri Lankan Central bank show that inflation in the country rose by 18.7 percent in March, compared with the same period last year. Food prices have jumped by 30.2 percent, with onions, dhal and rice costing double what they used to. The price of tomatoes has tripled, while that of turmeric, which is imported, has quadrupled.

Vendors at a fruit and vegetable market in Narahenpita, in the southeast of Colombo, said they had enough supplies but that people no longer had the money to buy their goods. At a stall that was well-stocked with carrots, beans, spring onions and chillis, PKP Sampath said “no one comes to buy food any more”.

Pointing at a customer holding a plastic bag that was only half full, Sampath said, “He’s been coming here for the past 13 years, and he used to buy several bags full of vegetables. Now, he’s had to cut down.”

The vendor said “people used to buy what they want” in the past, but now, “they only buy what they need to survive.”

At the adjacent fruit stall, Shriyani Jayasuriya, who was stocking up on watermelon, said she might have to close her food business because of the high cost of produce. The owner of Kindred Foods said she used to get at least 50 customers a day, but now, it was only 10 or 12.

“These are terrible times,” she said. “We cannot live in Sri Lanka.”

Many business owners said the crisis has hit the middle class the hardest.

Shiranshi Jayalath, who owns a salon in Ethulkotte, said she may also have to close shop due to power cuts lasting at least four hours during the day. Speaking from a protest outside the parliament, the 43-year-old said she has already had to let go of three of her workers.

“The middle class itself is disappearing,” she said. “This government needs to go.”

The construction sector has also been hit hard.

“Prices of cement and reinforced steel have tripled and the bank loans people have taken out for home construction are no longer sufficient,” said Dilina Hettiarachchi, a 37-year-old structural engineer. “They have no hope of completing their homes.”

Bigger projects were continuing, however, he said, as the industry’s strongest players had stocks of material as well as the foreign currency reserves to buy what they need. But even they were not taking on any new projects, he said, demonstrating just how widespread the impact of the crisis is.

One resident said the well-to-do in Sri Lanka have typically been insulated from the multiple crises that have roiled the country. But now, they are watching the situation unfold with a “new horror” as the value of their savings drop by the day.

In March, many rushed to get rid of their rupees by buying up gold, only to send up gold prices to a record high at the end of that month.

As the crisis worsens, anyone who can leave Sri Lanka is planning to do so.

Antoinette Prabalini Benjamin George, a 30-year-old lawyer, is one of them. But the dropping value of the currency has complicated her plans.

George applied for a bank loan of 2.2 million Sri Lankan rupees to go study abroad two months ago. At the time, 200 rupees could buy one US dollar. But by early March, the pegged value of the rupee dropped to 230 to a dollar, and by the first week of April, it was hovering at 300 rupees to the dollar.

George said the loan she had applied for was no longer enough, and it was also unclear if any Sri Lankan bank would issue her the foreign currency she needed to pay for her tuition fees.

One official at the Commercial Bank told Al Jazeera the bank was not issuing any foreign currency to new students seeking to leave the country, while those who were already abroad are facing “inordinate delays” in getting their payments approved.

But George said she is determined to leave.

“I think the value of the rupee will only decrease,” she said.

“When I was first making my plans, the country was already in a bad state. And then things only got worse. I’m going to find a way to leave.”

SOURCE: AL JAZEERA